HomeVantage Current Account at ICICI Bank UK

Simplify your banking experience with ICICI Bank UK’s HomeVantage Current Account solutions. Creating an account is as simple as downloading our mobile app and following the step-by-step registration process.

The HomeVantage Current Account gives you complete access to your money – 24x7. This bank account is specially designed to meet your banking needs in the UK and India - View your UK & NRI Account information together and helps in building credit footprint in UK.

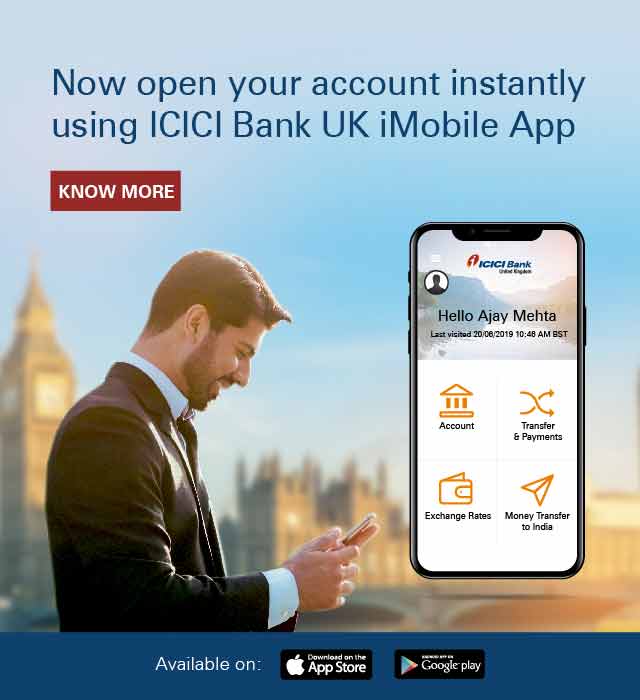

Instant Account Opening via our Mobile App*

Instant transfer to any bank in India

Contactless Debit Card

Get extra savings

Scroll to Top