Money Transfer to India at ICICI Bank UK

Do you want to send money to India?

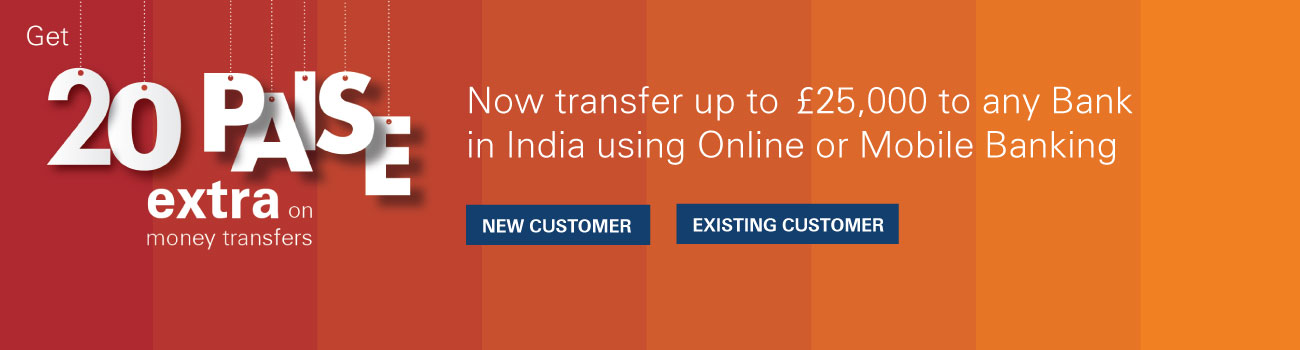

Enjoy instant money transfers from UK to India through App, Website, Branch or on the phone. With ICICI you can instantly transfer funds to any bank in India at confirmed exchange rates. Few of the non-ICICI beneficiary banks may take up to 1 business day to receive credit in India.

24x7, 365 Days availability

Transfer money to India anytime with us

Confirmed exchange rate

Money transfer with confirmed exchange rate

Easy Accessibility

Access via Online, Mobile App, Branch Banking and Customer Care services

Service Assurance

Dedicated customer Support on all remittances to India

Scroll to Top